Farm Equipment Leasing Agro4you Ltd

The Gym Journey Buying vs Leasing Equipment ClubRight

Deciding to purchase or lease farm equipment is a big decision and many elements should be considered. Each farm has a unique situation and thus legal, accounting, and business circumstances need to be factored into the final decision. References. Lemmons T. Leasing Vs. Buying Ag. Machinery: Factors to Assess. 2009. Institute of Ag. and Natural.

Owning vs Leasing Farm Equipment Which is Better?

Leasing vs Buying Farm Machinery; Topics: Business & Community; Overview. Equipment leasing has gained favor with farmers and ranchers in recent years. This publication discusses how to determine lease cost and analyzes lease vs. purchase options. An example of such an analysis is included. (4 pages)

Owning vs Leasing Farm Equipment Which is Better?

It's important to consider both the pros and cons to this decision and consider what effect lease vs. purchase decisions have on the tax return. Pros. Leasing equipment can make a positive change to your balance sheet. Reducing debt will improve the debt to asset ratio for a farm that has equity in asset. We will also see improvement in the.

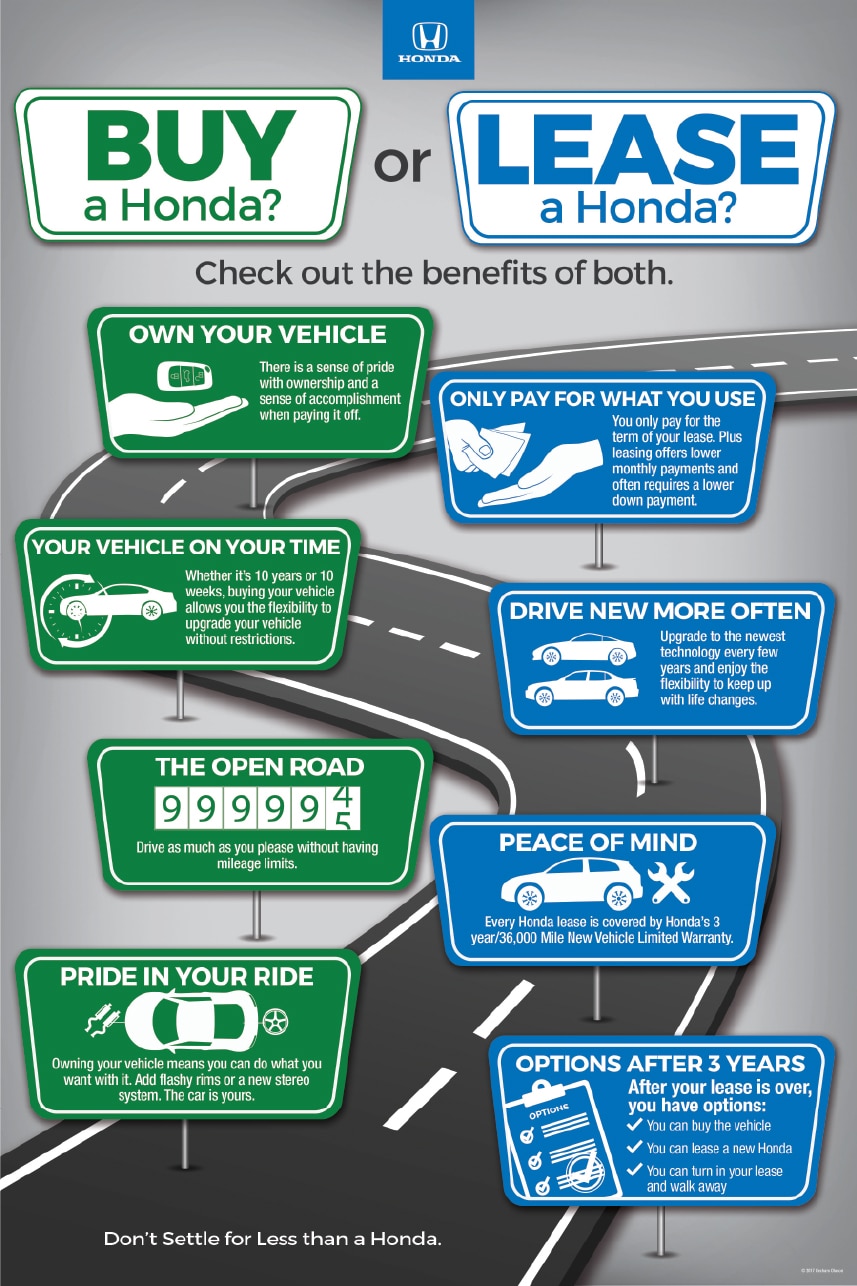

Buying vs Leasing Sheehy Honda

Buying farm equipment requires calculating the overall yearly cost of ownership. Generally, when comparing the costs of leasing versus purchasing, some variable costs will be constant, such as repairs (in a lease, these are the responsibility of the lessee), fuel and lubrication, insurance, and housing; thus their effects may be negated.

Leasing vs. Buying Agriculture Equipment National Leasing Lease, Business, Custom

Consider both the pros and cons before making a decision to lease rather than buy equipment. Tim Lemmons, UNL Extension educator in Cass County, says that, based National Agricultural Statistics Service, machinery and equipment expenses and fuel expenses have gone up nearly 25% the last two years.

Tax considerations when leasing farm equipment Fletcher Mudryk LLP Chartered Professional

The Pros of Buying Farm Equipment 1. Ownership and equity. Buying farm equipment offers farmers ownership and equity, allowing them to use the equipment as an asset and collateral for loans. Additionally, owning the equipment enables farmers to customize and modify it to meet their specific needs, increasing operational efficiency and productivity.

Leasing vs. Buying a Car Burns Ford of Lancaster Blog

Having the right equipment makes a huge impact on your operation, but getting that machinery often represents a significant cost in your budget. When it's time to consider financing options, you may want to weigh the options of buying vs. leasing equipment. Buying Farm Equipment. You may want to purchase your own equipment if you:

Office Equipment Leasing Vs Buying Equipment » CnwinTech

Disadvantages of Leasing Farm Equipment. One significant drawback is the potential long-term cost, which can be high to begin with. While smaller upfront payments may be appealing, over time, as leases extend year after year, the cumulative costs can become burdensome. Farmers relying on farm loans should also be aware of the usage restrictions.

6 Benefits to Leasing Farm Equipment Thomcat Leasing Canada Blog

Tax differences. However, the two methods of financing equipment have different tax ramifications. As a general rule for managing a high tax liability, buying equipment will be preferred over leasing. Leasing can be a way to finance a new building, and sometimes it is more attractive to lease a building than to purchase.

Leasing vs buying farm machinery on finance AutoTrader

Farm Equipment Leasing : Farm Equipment Buying : Long-term Costs: While leasing can be cost-effective in the short term, over an extended period, lease payments may exceed the cost of purchasing the equipment. No Ownership: Farmers don't own the leased equipment, limiting their ability to build equity or sell the equipment for cash. Restrictions and Penalties: Leasing agreements may have.

Leasing vs Buying Farm Machinery Publications AgriLife Learn

Farm equipment leasing encompasses a wide range of new and used machinery, including tractors, combines and other harvesters, planters, sprayers, forage and hay equipment, irrigation systems and other specialized equipment essential for modern agricultural practices. As the demand for equipment leasing continues to rise, a trusted financing.

Leasing vs Buying a Car Pros And Cons Bad Credit Car Loans Canada

Buying farm equipment. One of the biggest advantages of buying farm equipment is that you own it outright and will build more equity than leasing. Additionally, owning your equipment gives you greater flexibility in terms of when and how you use it, as you are not bound by any lease agreements. You can modify machinery to suit your specific.

Leasing vs. Buying Equipment Pros, Cons, & Considerations

Several advantages come along with leasing, such as: Flexible payment schedules and lease options. Ability to acquire specialized pieces of farming technology as needed. Lower upfront purchase cost compared to ownership. Reduced risk from unexpected breakdowns or malfunctions due to included maintenance services.

The Pros and Cons of Leasing vs. Buying a Car My Money Troubles

Pros & Cons of Farm Equipment Leases. If you are looking at leasing, it's important you consider what effect leasing vs. purchase decisions will have on tax returns. Not that long ago, leasing farm equipment was considered the poor stepchild of acquiring iron. Today, lower farm income and tighter lending requirements have farmers considering.

Farm Equipment Options Buying, Leasing, and Renting Smart Ways To Live

Leasing offers the flexibility to purchase, renew, or return the equipment when the lease expires. Leasing can also act as a hedge against market volatility and interest rate fluctuations. Fixed lease payments enable businesses to forecast and manage their cash flow more effectively, avoiding the uncertainty of variable-rate loans.

Leasing vs Buying Commercial Laundry Equipment Which Right for You?

Equipment leasing has gained favor with farmers and ranchers in recent years. This publication discusses how to determine lease cost and analyzes lease vs. purchase options. An example of such an analysis is included. (4 pages)